Friend Shares

At the end of 2023, 1,872 Coolbluers were Coolblue co-owner, as they had been awarded Friend Shares. These depositary receipts for shares were granted in 2021 and 2022 to Coolbluers who at that time had been working at Coolblue for more than a year.

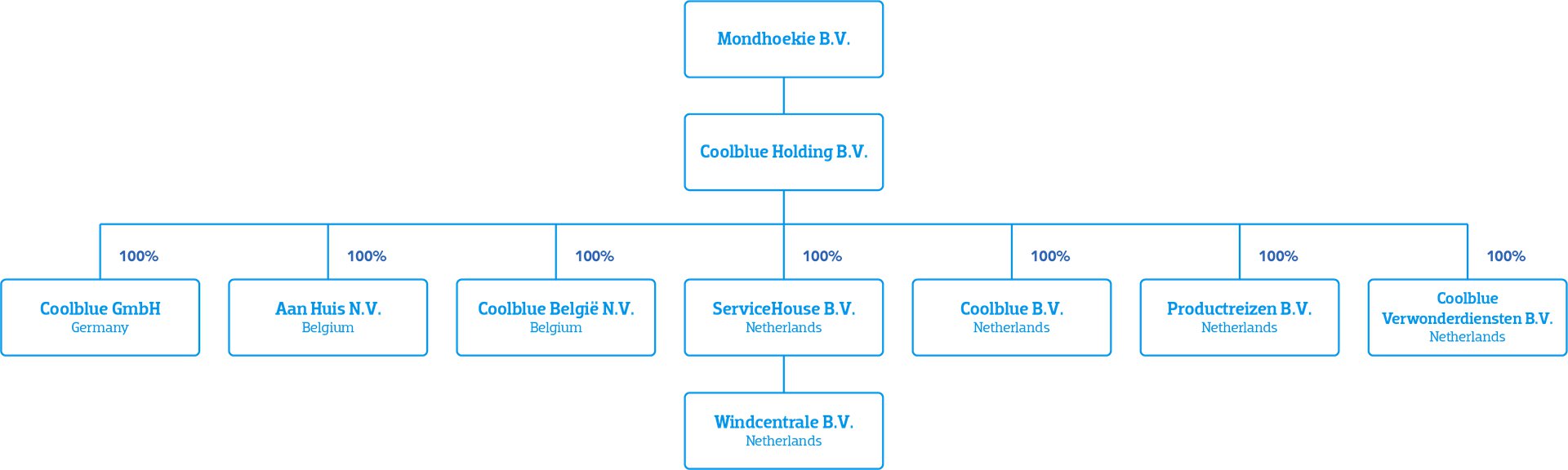

Structure

We keep our corporate structure as simple as possible. We are active in the Netherlands, Belgium, and Germany via various corporate entities. They are all fully owned by Coolblue Holding B.V., a private company with limited liability (besloten vennootschap) under Dutch law, which in turn is fully owned by Mondhoekie B.V.

Management Board

Coolblue’s Management Board consists of Pieter Zwart and Daphne Smit.

Pieter Zwart

Age: 46

Position: CEO

Working at Coolblue since: 1999

Education: Business Administration at Erasmus University Rotterdam.

Responsibilities at Coolblue: Category Teams, Customer Experience, Stores, Tech, Purchasing, Germany, Business Journeys, Exclusive Brands, Coolblue Energy, and Marketing

Daphne Smit

Age: 38

Position: CFO

Working at Coolblue since: 2014

Education: International Business Administration at Erasmus University Rotterdam.

Prior to Coolblue: Trainee, Account manager, and Credit Analyst at Rabobank.

Responsibilities at Coolblue: Finance, Delivery & Installation, Warehousing, Returns & Repairs, Customer Service, Corporate, and Human Resources

Support

The Management Board is supported by: A commercial management team of purchasing, marketing, and commercial experts; Separate management teams for each operational domain, with specific individuals responsible for technology and infrastructure, operations, and HR matters respectively; and Experts who advise on general aspects of Coolblue’s business, such as Finance, HR, or Legal.

Remuneration

The Management Board’s salaries are determined by the Supervisory Board. Members of the Management Board receive a fixed salary. They are not entitled to bonuses, options, or shares in the company as part of their remuneration. Pieter and Daphne are shareholders in Mondhoekie B.V. Any shares they have acquired, have been acquired on commercial terms.

Corporate Governance Code

We acknowledge the importance of good governance. We are not legally obliged to follow the Dutch Corporate Governance Code, but we do actively monitor relevant developments in the Corporate Governance Code and incorporate the principles that are relevant to us as a private company.

Supervisory Board

Coolblue’s Supervisory Board is a group of experienced entrepreneurs and investors. They form an independent body that supervises Coolblue’s policies and daily order of business. They also serve as a friendly yet critical sounding board to the Management Board. The Supervisory Board and each of its members are committed to Coolblue’s interests, its customers, and all other parties involved. Currently, our Supervisory Board consists of 5 members, each with their own background, experience, and expertise relating to different aspects and activities of Coolblue.

Jaap van Wiechen

Jaap van Wiechen (51) is a member of the Executive Board of HAL Holding N.V. and serves as a member of the Supervisory Board of Boskalis and SBM Offshore. Jaap acts as chairman of the Supervisory Board and is a member of the Audit Committee.

Theo Kiesselbach

Theo Kiesselbach (58), a German national, is a retail expert. He started his professional career at McKinsey & Co. Afterwards, he held executive roles in a number of German retail companies, followed by a long career as CEO of Grandvision. Currently, he serves as board director and advisor for various companies.

Maurine Alma

Maurine Alma (55) is the CMO at Just Eat Takeaway.com and member of the Supervisory Board of the Van Gogh Museum. Maurine’s previous positions include executive roles at Google and Procter & Gamble.

Bert Groenewegen

Bert Groenewegen (60) is the CFO of Nederlandse Spoorwegen and a member of the Supervisory Board of Teslin Participaties Coöperatief U.A. Bert’s previous positions include CFO at Exact Holding, CFO/CEO at PCM Uitgevers, and CFO at Ziggo. He is chairman of Coolblue’s Audit Committee.

Harold Goddijn

Harold Goddijn (63) is the CEO of TomTom and a member of its Management Board. He co-founded TomTom in 1991, having previously founded Psion Netherlands B.V. in 1989 as a joint venture with Psion Plc. Harold holds a Master’s degree in Economics from the University of Amsterdam. He was knighted in the Royal Order of Orange-Nassau in 2016.

Supervisory Board report

Hello everyone,

Coolblue is an organization that is known for its focus on customer satisfaction and unconventionality. This is reflected in how the company goes about internal and external developments and challenges, like new propositions, the energy market, labor market, consumer behavior, and many others. To match this approach, we as members of its Supervisory Board (installed at Mondhoekie B.V. level) also have to adopt the flexible mentality that characterizes Coolblue. This proves an interesting and challenging assignment, which we gladly take on.

Activities of the Supervisory Board

In 2023, we had 5 official meetings with the Coolblue Management Board. These meetings were held in different locations, like the store in Utrecht, the warehouse, the head office in Rotterdam, and the Coolblue Energy office in Utrecht. Of course, we also had frequent interactions in between. During these meetings, we discussed recurring topics such as customer satisfaction (NPS), strategy, market developments, and financial and operational results.

Additionally, we discussed more specific topics, such as the developments in the energy markets, the expansion in Germany, and the mechanization of the Coolblue warehouse and the new store concept. Often these topics were introduced by a presentation, given by the responsible manager.

We greatly appreciate the explanations given by these managers, because they provided us with better insight into the dynamics of the business and the people that make Coolblue.

Audit Committee

The Audit Committee supports the Supervisory Board in the supervision of financing, reporting, internal controls, and risk management.

In 2023, the Audit Committee met 3 times with the CFO, Head of Finance, and the external auditor. During these meetings, the following topics were discussed: the financial statements of 2022, the audit planning for 2023, the findings of the interim audit and internal control findings in 2023, ESG developments, Tech organization, tech security risk management, the strategic risk assessment, tech security, fraud, the refinancing of credit facilities, and compliance with laws and regulations.

Going forward

Growth continued in 2023. Management acted proactively, focusing on improving the efficiency of the operations whilst maintaining a growth mentality. The Supervisory Board is pleased with the developments at Coolblue over 2023 in the Netherlands and Belgium, and particularly with the expansion in Germany and the growth and new propositions of Coolblue Energy. This all resulted in an increased profitability and a positive outlook on the further development of profitability. We appreciate the flexibility and continuous effort of every Coolbluer, and we are confident that this will lead to positive developments and results in 2024.

The Supervisory Board appreciates how Coolblue keeps taking corporate and social responsibility, as always with its characteristic own touch. Coolblue takes its responsibility through new propositions and by building on already existing propositions, for example by strongly reducing its cardboard consumption through installing machines that tailor packaging to size, improving the re-use of returned products, refurbishing washing machines, delivering packages by bike, and helping its customers save on their energy consumption.

Looking ahead after what has been another eventful year for Coolblue, given the enormous dedication of Coolbluers to each other and to the organization,

we believe that 2024 is bound to become a great year for Coolblue

On behalf of the Supervisory Board,

Jaap van Wiechen

Chairman

Bert Groenewegen

Harold Goddijn

Maurine Alma

Theo Kiesselbach

Diversity

Coolblue acknowledges the importance of diversity in a working environment. We recognize and welcome the value of diversity with respect to gender, age, race, ethnicity, nationality, sexual orientation, and other important cultural differences.

In accordance with the Gender Balance in Management and Supervisory Boards Act, we have implemented a gender diversity policy. In this policy, we have set target ratios for gender diversity. We aim for at least 33% female members and 33% male members in the Management Board (50% female at the end of 2023), the Supervisory Board (20% female at the end of 2023), and senior management ([28% female] at the end of 2023). We think the Management Board, Supervisory Board, and senior management currently represent a diverse mix of personal backgrounds, experiences, qualifications, knowledge, abilities, and viewpoints.

For Coolblue, the principle of being “the right person for the job” shall at all times remain the guiding principle in the selection of new members for the Management Board, Supervisory Board, and senior management. Our current plan to further improve gender diversity in the composition of the Management Board, Supervisory Board, and senior management is that we will actively seek and consider this when evaluating new candidates in the best interests of Coolblue and its stakeholders. In case of vacancies, Coolblue will also internally stimulate to look for candidates that match a profile which further increases gender diversity within its Management Board, Supervisory Board, and senior management.